How to Create Product

Introduction This guide provides a step-by-step process to create product bundles using the EdgeTariff Bundle feature. By following these instructions, you can efficiently

Remove the uncertainty for overseas buyers, who need to see the expected duties & taxes on your store’s check-out, so they aren’t caught by surprise. This TOTAL LANDED COST allows buyers to make an informed buying decision, which removes buyer’s remorse and promotes returning business.

We care about your data in our privacy policy.

Learn instantly the cost for sending goods Delivery & Duty Paid (DDP) from and to your chosen countries.

Main features

EdgeTariff provides you with several tools that makes selling to oversea buys as simple as selling domestically, so you can grow internationally hassle-free.

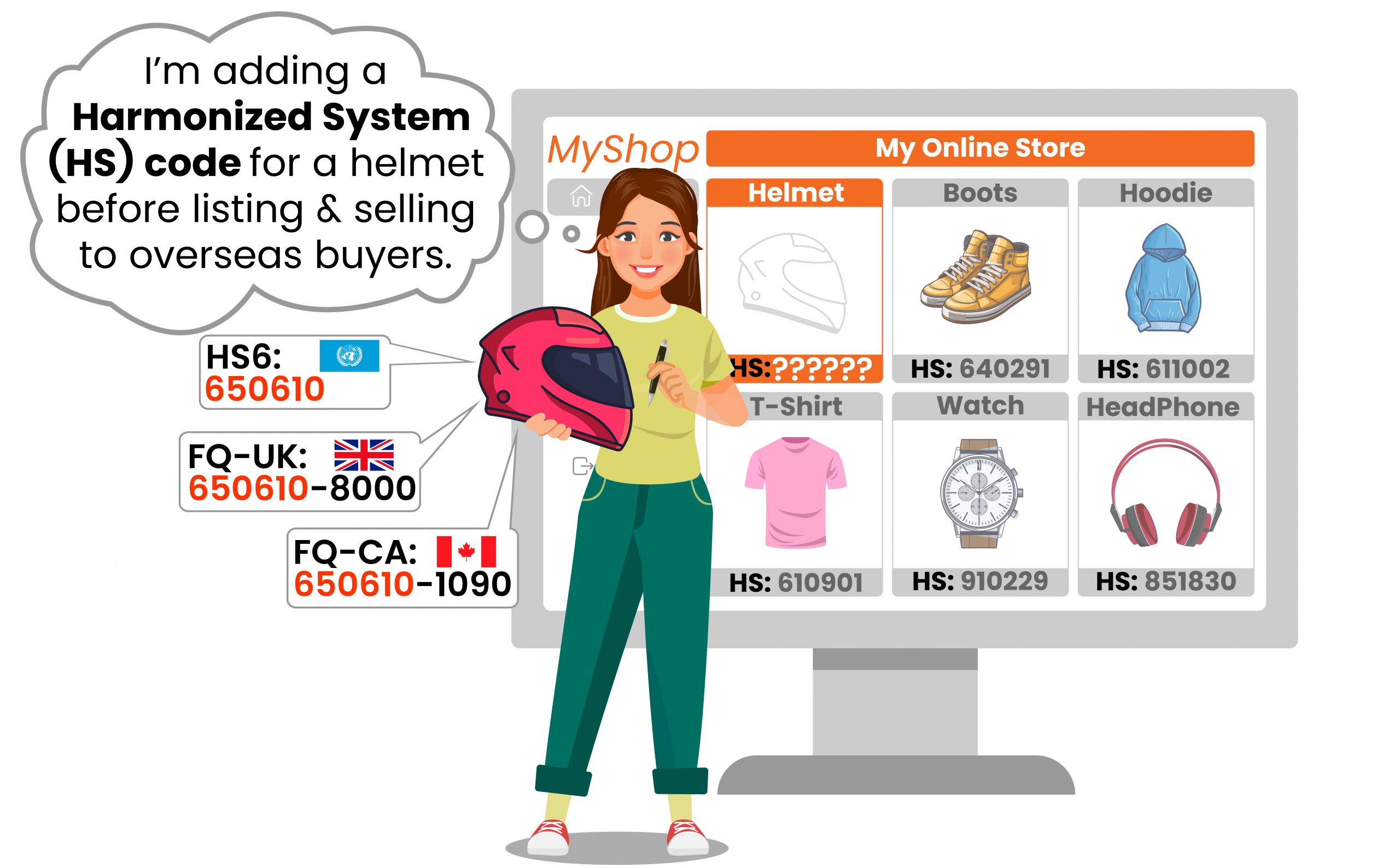

Before selling your goods overseas, a necessary first step is to classify your goods by assigning them Harmonized System (HS) codes. HS codes allow global customs authorities to recognize your goods and apply the correct import duties and taxes. The first 6-digits of the HS code are known as the HS6 and are universally recognized by customs authorities in over 200 countries. Additionally, you can extend the HS6 to destination country specific 10–14-digits, called the Fully Qualified (FQ) codes, which makes your goods recognized by those specific importing countries.

HS6 means your import duties & taxes are calculated on a global “average” basis. FQ codes means the duties & taxes are specifically calculated for the importing country. As a result, FQ codes provides a more accurate duty & tax calculation, usually greater than 98% accuracy, than just using an HS6 code, which is around 85% accurate.

You mostly only ever need to classify your goods once in their life-times, so putting in the effort to classify your goods to either HS6 or FQ levels is a one-time effort. Additionally, you only need to classify the “parent” products, i.e., NOT the variants, so sizes, colors etc., do NOT need to be classified because they inherit the classification of the parent product.

When getting your goods classified its best to get expert licensed customs brokers, with decades of experience, to classify your goods accurately, considering any contextual aspects in the classification (i.e., manufacturing process), which sole AI (artificial intelligent) classification solutions lack. After all, you don’t want the wrong classification impacting the results of your expected duties and taxes calculation.

EdgeTariff’s Product Pre-Classification (PPC) tool, lets you get your products classified (by expert humans not just AI) to both the HS6 and FQ levels. This means you get class-leading product classification, which accurately drives the expected duty & tax calculations for showing the total landed cost on your online store’s check-out, B2B quotations and invoices.

Having gotten your products classified with Harmonized System (HS) codes, to either the HS6 or FQ levels, you can begin selling them to overseas buyers. The HS6 or FQ codes will be used by the landed cost calculator to show the duties & taxes on your online store’s checkout.

Why use a landed cost calculator? Landed cost calculators allow you to calculate, upfront, the total costs associated with shipping goods from one country and importing them into another. The best landed cost calculators take into consideration: the cost of the goods; end-to-end shipping charges; factor in import duties and taxes of the destination country by using the HS6 or FQ codes; account for free-trade agreements and de minimis rules etc. and show the total landed cost to the buyer on the checkout. The buyer can then make an informed buying decision, rather than being surprised by import delays and unpleasant duty and tax demands, which creates buyers' remorse and resistance to buy again.

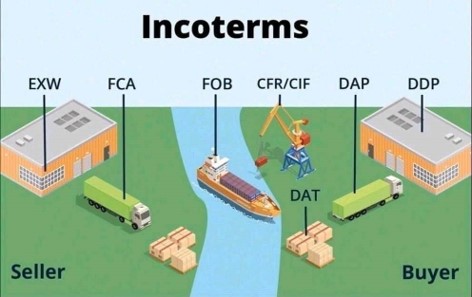

Another reason for using a landed cost calculator is that as a seller, you get to provide Delivery and Duty Paid (DDP) delivery terms or incoterms, which means to you that shipping overseas just got as easy as shipping domestic. How? Since you’ve pre-calculated the duties and taxes, and collected the cost of the goods, shipping charges and duties & taxes, upfront from the buyer, you simply print the dispatch label with DDP marked on the label. This tells the logistic carrier that you (the sender of the goods) will pay the duties and taxes too, in which case, the carrier simply deliver the goods to the buyer, and clear customs on your behalf. Later the carrier bill you for the shipping and duties & taxes, which you’d pre-collected from the buyer anyway. You as the seller don’t then need to do anything relating to customs declarations etc., because the carrier has already done this for you under the DDP delivery term. As a result, going global just got as easy as domestic trading.

Why use the EdgeTariff Estimate Duties & Taxes (EDT) calculator? Well, EdgeTariff uses the best-in-class duty & tax calculation data for over 200 countries to provide the most accurate duties & taxes on your checkout, showing your buyers the total landed cost. Why’s it an estimate if it’s that accurate? Because currency fluctuation and transport packaging may vary the final landed cost, however, you’ll still get class-leading (>98%) accuracy.

Knowing who you are sending or receiving goods from internationally is a compliance requirement. Your buyer or supplier may be on a restricted person list, and you would, therefore, be prohibited in sending or receiving goods from them. Restricted party lists are held by country-level government agencies and global organizations, e.g., United Nations or European Union etc.

EdgeTariff makes it easy to screen your buyer or supplier against over 32 dynamically updating global lists, searching for restrictions that would warn you from transacting with restricted parties and thereby keeping you compliant. Use EdgeTariff’s Restricted Party Screening (RPS) tool to identify if a customer has any restrictions or not BEFORE you ship your goods to them.

Why risk sending goods to an unknown individual, when EdgeTariff’s RPS only take seconds to run and keen your compliant.

From an overseas buyer’s point of view, knowing the expected duties and taxes on the checkout, before they purchase the goods, is value-adding in making the buying decision and reduces their uncertainty on the exact financial cost to them. To further reduce the uncertainty for the buyer, the duties and taxes, in fact the entire checkout, can be switched into the buyer’s local currency, which eliminates the risk of the exchange rate working against the buyer and therefore, lets the buyer make an informed choice based on the known financial cost of the goods.

EdgeTariff lets you switch-on foreign exchange (FX) rates, so the entire checkout, including the duties and taxes, is shown in the buyer’s local currency (based on their browser’s internet location). For example, a UK store visitor can see product prices, cart content and checkout total landed cost in GBP (Pounds Sterling), which gives the UK buyer complete confidence that the price they pay, is the only payment they will need to make, and they’ll now just simply get the goods, i.e., makes it as simple as making a local purchase for them.

Remember confident buyers, buy more, so give your overseas store visitors the confidence to buy by show all the financials on the checkout in their local currency.

Delivery Duty Paid (DDP) incoterm or delivery term is the easiest way for an international buyer to receive the goods they have purchased because the seller takes the responsibility to get the goods to the buyer. That is, the seller must pay for all transportation and custom charges and deliver the goods to the buyers chosen location. Although DDP is easy for the buyer, some people regards DDP as being onerous on the seller. However, if setup correctly, DDP does NOT need to be burdensome to the seller either.

As a seller, start by getting a logistics company that will deliver your goods on a DDP incoterms basis. This is because you’re going to need the logistic company to clear customs and pay for all the necessary charges for you.

Next, you’ll need a total landed cost calculator that upfront shows you (and the buyer) the cost of the goods, delivery charges, and expected duties & taxes, i.e., the total landed cost. You’ll then collect the entire amount (total landed cost) from the buyer, i.e., the buyer pays you for the lot.

Now, you arrange the goods shipment (fulfilment) as normal. However, you make a few small adjustments when generating the shipping label to instruct the logistics company: a) indicate that the “Duties and taxes should be billed to the payer of the shipping charges”, i.e., you as the seller (and not to collect it from the buyer) and b) any label options should show “Delivery Duty Paid (DDP)”, so the delivery terms are clear. The logistics company will then deliver the goods to the buyer and clear customs (paying all/any custom charges) for you. Neither the buyer nor you (the seller) need to do anything with customs. The logistic company handles it all. As a result, using DDP like this makes international shipping as simple as domestic shipping for both you and the buyer.

Finally, as part of your normal billing cycle with the logistic company, you’ll get billed for the shipping charges and any duties & taxes the logistic company had paid to clear customs. The logistics company may tag on a disbursement fee, which is the fee for clearing and filing the necessary customs paperwork etc., however, some logistic companies waiver this fee. EdgeTariff provides the full DDP process mentioned above and allows you to grow your business globally without the perceived pains of international trade compliance.

What are bundled products? Basically, bundles products consist of several single products grouped together to make a single sellable product, usually with a discounted collective price rather than if the several single products were purchased separately.

There are two type of bundle products:

Buyer-created bundle, where the store owner presents an empty “carton/box” that can hold a set number of products, and the buyer chooses the products that go into the carton/box.

For example, a motorcycle apparel seller, could have a pre-define “starter rider” bundle, which consists of five single products: helmet, gloves, jacket, pants and boots, all for a bundle price of say $999 USD. Individually, the five products (if purchased separately one-by-one) could sum to say $1199 USD, so buying the pre-defined bundle would save the buyer $200 USD.

As another example, a buyer-created bundle, could have a carton or box size of say six candy bars, and during buying the buyer can self-select the flavor of candy bars to add to the box, e.g., 3 milk chocolate, 1 dark chocolate and 2 caramel centers, which completes the 6-bar box size.

EdgeTariff can provide the duties and taxes for both types of bundles when selling them to overseas buyers, which means selling more internationally just got a whole lot easier.

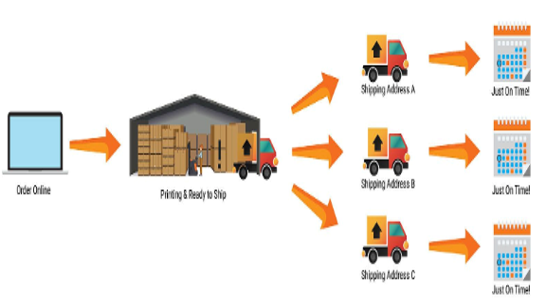

Shipping to multiple addresses from a single checkout is a great feature that your buyers can use when sending gifts to friends and families around the world. Multi-Destination Shipping (MDS) allows the buyer to simple purchase a number for products from your online store, and at the checkout assign the addresses to where the products needs to be shipped – easy! MDS means that the buyer does NOT need to repeatedly visit the online store and checkouts for each address to where a product needs to be sent.

For example, if the buyer wanted to send five different products to five different addresses (whether national or international), conventionally the buyer would need to perform five checkouts repeatedly (one for each destination address). With MDS the buyer simply puts all five different products into the cart and proceeds to the checkout, where the buyer simply assigns the five destination addresses to the five products; adds any special instructions or messages to each destination recipient (e.g., a birthday or seasonal greeting) and pays for the combined order. In the background the combined order is split into the different (e.g., five) destination address orders, so you can fulfill them easier (or at different intervals).

EdgeTariff is the world’s first total landed cost that has MDS built-in, which means the buyer gets the ability to specify multiple destination shipping addresses from one checkout, and for international destinations, gets to see the duties & taxes applicable for those product(s) and destination country/countries. Total landed cost (or DDP delivery terms) is important for those buyers who are sending gifts to overseas friends and families because the recipient should NOT be asked to pay for any duties and taxes before receiving the gift!

EdgeTariff’s EDT (Estimated Duties & Taxes calculator) coupled with MDS means a true international gift shipping experience for your buyer, and the convenience of doing all this from one single checkout results in higher customer satisfaction and repeat business.

If you have your own developed eCommerce store, which is not on the currently EdgeTariff supported platforms, and you have access to your own web development team, then you can build a connection service to the EdgeTariff API. The EdgeTariff API provides you with the three services of Product Pre-Classification; Estimated Duties & Taxes (EDT) and Restricted Party Screening (RPS), and let you connect your carrier shipping rates call into the API too.

The Application Program Interface (API) architectural technology used in the EdgeTariff API is RESTful and we provide sandbox environment for you to develop and test your solution against before moving to live. We also provide JSON and PHP code samples along with a JS SDK to make development simple. Nevertheless, our entire development team are here to support your API connection efforts, so that you get started as quickly as possible.

Click here to see download our latest EdgeTariff API guide and contact us to get started right away.

Go to the app store, install EdgeCTP and get started with EdgeTariff in 2 mins.

Pricing

Priced to add value – only when you win!

No, generally you only need to perform PPC on your products once in their life-time, and NOT each time you trade them. Also, you don’t need to do variants, just the primacy/parent product needs to have PPC performed on it.

It takes about 24-hours to pre-classify your products, either individually or via an upload-able spreadsheet of multiple products. EdgeTariff uses licensed customs brokers to analyze, validate and classify your products. Our research has show that AI for classification is at best 35% accurate, which means incorrect duties & taxes calculations and subsequent customs impact.

Getting started can take anywhere between 30 mins (e.g., a simple Shopify installation and connection) to 30 days (e.g., major API development from your side). There is a $2,500 one-off onboarding fee for those clients whom we assist/wait for over 30 days from the initial demo, which we waiver (as a limited time offer) in the event we can get you onboarded within 30 days of getting started.

No. We do NOT take a percentage of the check-out as fees. We simply charge you a flat fee for each check-out that turns into an order. That is, if a cart/check-out is abandoned, after the duties & taxes are calculated, you are NOT charged a cent, which is an industry first in this class.

Yes. We have a limit of 5 stores (different URLs) that can be run from a single EdgeTariff account. Do you want more stores? Then contact us and we’ll extend your limit.

Our insights

Introduction This guide provides a step-by-step process to create product bundles using the EdgeTariff Bundle feature. By following these instructions, you can efficiently

Overview This guide shows you how to install and connect your WooCommerce store with EdgeTariff so that the plugin can provide the functionality

Start your 30-day free trial. Cancel anytime.

Credit card required for full features. Contact us for assistance.

Blog

EdgeTariff © 2026, All rights reserved.